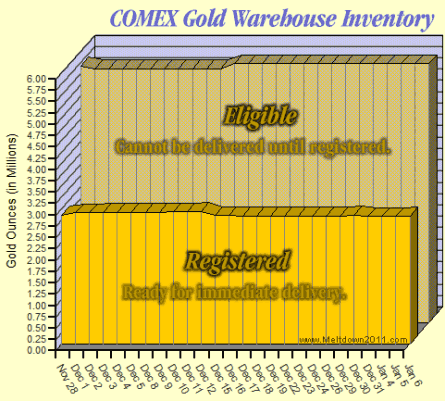

NOTE: Latest COMEX Gold Inventory chart is to the right, in the sidebar.

NOTE: Latest COMEX Gold Inventory chart is to the right, in the sidebar.

Here’s the latest COMEX Gold Inventory chart. (If you can’t see it click the title of the post above.)

Please, let me be the first to call myself an idiot.

No, I insist! Really.

In the previous “Vaporize COMEX” charts I plotted the MTD deliveries against the inventory numbers provided by COMEX. I subtracted the delivery ounces from the reported inventory assuming the inventory levels would be adjusted downward after the end of the delivery month. It looked as if 48.1% of COMEX gold had been depleted.

Wrong-o, moose breath!

All my previous charts were wrong. It appears the reported inventory levels have already been reduced by the “net” delivery amounts.

In other words, the major gold and silver speculators are playing a shell game: when they “take delivery” they just move the metal from one “registered” pile in one of the COMEX-approved warehouses to another. There is, so far, rarely any actual physical delivery. The chart above shows almost no metal has left the warehouse.

On Nov 28, first notce day for Dec gold deliveries, COMEX reported 2,855,567 “registered” ounces. On Dec 31, the day after final notice day, COMEX reported 2,826,953 “registered” ounces. This is an inventory depletion of only 1.0%.

Cornholio, I think you may have mentioned something along these lines when you said there was no way COMEX would be busted. Sure looks to me like you’re right.

Assuming COMEX is honestly reporting their inventory levels, and that the gold physically exists, it’s gonna take some seriously deep pockets to bust COMEX.

About COMEX Failing to Deliver on “MiNY” Contracts

I know some of you have been getting excited about this story:

Is Comex Doing Fractional Reserve Delivery of Gold?

But is this really significant? IMO COMEX is just discouraging miNY contract holders from taking delivery by setting the bar a little higher. If you have to have three miNYs to take physical delivery you might as well just pony up for the full contract. It doesn’t seem COMEX has any problems delivering 100 oz bars.

What do YOU think? Comments are opened below…

Filed under: Vaporize COMEX CountDOWN | Tagged: COMEX default, vaporize COMEX |

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)

[…] Derzeit halten verschiedene Banken an der COMEX offene Gold Verkaufskontrakte über 16 Millionen Unzen Gold. Allerdings liegt der Lagerbestand nur bei ca. 3 Millionen Unzen […]

I am trying to figure this out. According to your numbers, in December only 30,000 ounces of gold were actually delivered to anyone who wanted to take it out of the COMEX vaults. That seems an imporbaly low number. Consider that the US Mint says that it sold many times that number of gold coins in the first 7 weeks of 09. Obviously other mints and manufactures of gold have produced similar or larger numbers (since the US mint is not the biggest producer of gold coins). Where is all this gold coming from?

Are all the mints and bar companies (PAMP, Credit Suisse, Johnson Mathey, Engelhard, etc.) getting their gold directly from the mines without going through COMEX or another similar overseas market? And if it is true that all the big users of gold are buying somewhaere other than the COMEX then how did it happen that the COMEX price became the “gold standard” (pun intended) in gold prices. It would seem that the place where gold actually changes hands should be the place where prices are set, not an exchange where virtually nothing real actually gets sold.

I was thinking of starting the Captbilly plutonium exchange. I don’t have any plutonium and if you trade on my exchange you can’t actually get any plutonium delivered (that would probably get me into trouble) but I will declare my price to be the official spot price of plutonium. Other might demand a premium above my price for actually delivering plutonium (one could imagine some nice not poisoned stuff, good for weapons work going for way over spot), but that is just what we have today with the COMEX.

Here is the real COMEX gold warehouses registered chart

http://www.24hgold.com/english/interactive_chart.aspx?title=COMEX%20WAREHOUSES%20REGISTERED%20GOLD&etfcode=COMEX%20WAREHOUSES%20REGISTERED&etfcodecom=GOLD

Hmmm… how did you navigate to this chart? I was unable to find some index/registry to see the same for he open interest / delivery volumes.

Thanks in advance,

Anton

Anton,

I used to track deliveries but eventually came to understand the delivery stats have little meaning: it’s essentially a “shell game” where the supposed physical metals are just pallet-jacked from one demarked area in the warehouse(s) to another. If COMEX published a category called “physical deliveries” then we’d have something to look at.

Tracking “registered” metal inventories (as I do in these charts) seems to be the most accurate indication of COMEX reserves.

BUT remember this: COMEX inventories are not independantly audited. For all we know they have as much gold as (the also unaudited) Fort Knox.

All the deceptions shall be revealed by January 2011 (Jim Sinclair’s famed gold price prediction), or sooner.

Thanks for reading,

Scott

Will you be doing a February chart?

The “Truth” About the Gold Market Today

http//www.gold-eagle.com/editorials_08/ash011409.html

By Bill Murphy 2001

The big news this week could come out of the Comex. All eyes will be on the June open interest, which stands at 50,347 contracts with only two trading days left until first notice day on Thursday.

While there are 827,000 ounces of gold in the Comex

warehouses, only 367,000 ounces are eligible for

delivery. Each June gold contract is 100 ounces, which

means there are still more than 5 million ounces of

longs that could compete for only 367,000 ounces of

gold available for delivery.

Why don’t you graph the registered level and the net flow (subtract out from in) of metal from the exchange.

If registered consistently declines then the eligible guys don’t want to sell or if there is a consistent flow of metal out of the exchange then there may be nothing to sell someday.

All of the other numbers are noise.

HA! The inability of those with prejudice to understand simple facts is truly hilarious!

You must have a receipt registered first in order to tender a delivery notice against short futures! HAHAHAHHAHAH! Your website was funny. At least you are capable of admitting your mistakes unlike most precious metal ‘analysts’ that spew nonsense about the evil futures markets designed to manipulate populist prejudice.

You can take delivery on minis, you just need a minimum of three mini receipts at a time.

Plenty of eligible gold in the Comex above the registered.

OPEN THE MINT TO GOLD!

Could a Private Firm Force the Government to Do It?

Antal E. Fekete

Gold Standard University

They say that this is a new phenomenon that first appeared in December, 2008, the same time when gold backwardation first appeared as a threat to close down Comex warehouses.

http://www.gold-eagle.com/gold_digest_08/fekete011109.html

If you get a chance check out the Gold Trail good reading at http://www.usagold.com/goldtrail/archives/goldtrailone.html

Scott,

Other good sites are quoting this site shared information is a blessing IMHO. Keep up the good work and I would like to say hello to the people at http://www.usagold.com/cpmforum/ .The post by Knallgold posted 12 Jan. At 4:24 and Speculator 11 Jan at 13:15 seems to be related USAgold is also a good site for information.

Dave – was that warehouse or whorehouse you were misspelling there ;-)

The proferred new explanation is itself very odd – why would anyone take physical delivery of gold only to put it straight back into the wharehouse that it came from, incurring extra charges and wasting time when the metal could be working ?

Perhaps it is a test that the speculators use to ensure they could get the physical metal if they really wanted it.

Or maybe it gives them the opportunity to choose between keeping the physical metal and redeploying it at COMEX, or anywhere else that needs physical metal to get you through the door.

Hi Gunther,

“Yes” to your first question, “Am I an idiot?” and

“Yes” to your second question, “Did I make an honest mistake.”

They’re not mutually exclusive, even idiots can make honest mistakes!

I’m still a huge gold and silver bug, with my personal emphasis on silver. I do, however, stand amazed at the level of duplicity and deception regarding COMEX and precious metals.

The Shadow Powers are digging deep into their bag-o-tricks to convince all of us there is NO SAFE HAVEN and, even if there were, it wouldn’t be precious metals. (“Run to Treasuries! Run to Money Markets!”)

As you point out, there ARE shortages. Eveidence enough is the simple fact that actual prices for gold and silver, for the first time, demand a huge premium over COMEX spot pricing.

Audit COMEX? I know Jim Sinclair said he would look into this very topic this weekend even though he’s travelling in Africa right now.

I look forward to hearing from him on the subject.

Thanks for taking the time to write such a thoughful comment!

Scott